Despite the market turmoil, industrials are still attractive. Look for this industrial stock to trend toward its 2007 peak.

The Stock: Stella Jones Inc. (SJ) Recent price: $36.52

Trend: Stock markets have felt the tremors of Japan’s natural catastrophe, with investors mindful, if not fearful of the negative impact on the global economy. Materials and energy stocks have taken a big hit; so, too have insurance stocks with exposure to the Asian tragedy. Uncertainty, always dry tinder in the market’s attic, has sparked enough to send many jittery investors to the exit. However, some sectors of the market may provide more committed bullish investors with a steady course through this turmoil.

When the stock market recoils it is illuminating to see which specific stocks perform well or appear relatively unmoved by the sudden shift in broad sentiment and heightened selling pressure. Typically, defensive sectors like utilities, consumer staples and healthcare show superior performance when the market goes sour. The recent market slide reflects that norm, but also reveals strength in consumer discretionary stocks, in pockets of the real estate sector and forestry stocks, which are scaling to new highs.

Bullish-minded investors not yet inclined to retreat to a defensive position will look for encouragement in the performance of industrial stocks. Although certainly not immune to the recent market downdraft, big multinational industrials like Caterpillar (CAT) and E.I. Du Pont de Nemours (DD) remain in Stock Trends Bullish categories – above their 13-week moving average trend lines. Included in the industrial group are transport stocks, which have also held up relatively well in the market retreat. Investors can look for opportunities to add to their portfolios industrial stocks that have tested support and shown positive signs of maintaining their prevailing bullish trend.

The Trade: While certainly not a well-known industrial name, Stella-Jones is a Quebec-based infrastructure play that flies below the radar of many investors. Railway ties and utility poles may not be the kind of business that inspires investor excitement, but Stella-Jones is a major North American supplier of these critical widgets. Railways, utilities, and telecommunications companies depend on these supplies to maintain and expand their fixed assets.

Stella-Jones has a relatively small market capitalization of $600-million and its stock does not trade that much (weekly volume usually amounts to only 0.15 per cent of outstanding shares) – both important considerations for investors who should be concerned about liquidity. But this stock has shown an impressive trend record over the years and the current selling fever gripping the stock market could slide off this gem. Strong 2010 financial results and a dividend hike suggest that the fundamentals supporting the current price are ample.

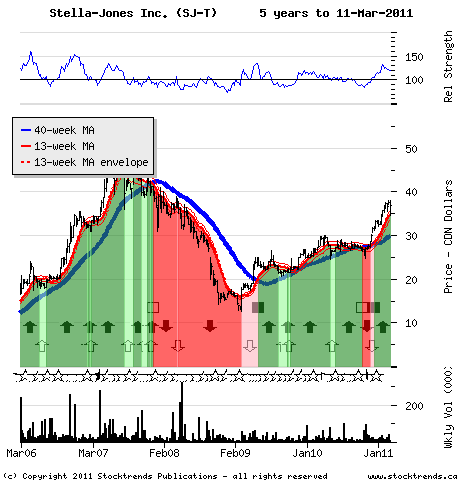

This stock has been Stock Trends bullish for some time, and was trend pick in the summer of 2009. More recently, the stock rallied since dropping briefly below its trend line last autumn and had been hitting new 52-week highs in regular fashion through much of 2011, before the current market quiver. Last week the stock retreated with the market to its 13-week moving average trend line, but quickly recovered to the $37 level, shy of its 2011 high. Look for this industrial stock to hold out well in market volatility.

The Upside: Despite its attractiveness as a trending stock, Stella Jones shares are still trading about half the weekly volume they did during the stock’s strong bullish trend from early 2005 to its peak in 2007 just shy of $50. An acceleration of trading volume is needed to help fuel further price momentum and another 20 per cent lift to the share price.

The Downside: Perhaps the bullish sentiment is misplaced, and the market downdraft is too much for this small cap stock. However, if the market calms, expect the share price to hold above $34.

Published in Stock Trends