A healthier economy brings back the shine for bank stocks. Look for shares of Royal Bank to gain traction.

The Stock: Royal Bank of Canada (RY) Recent price: $56.74

Trend: Retail traders looking for a strong card as they play with anxious market investor sentiment should be drawing on the current shine of Canadian banking stocks. Although most of these big, diversified financial institutions have been categorized as Stock Trends bullish since the summer of 2009, February was a positive month with already bullish bank shares rallying off trend line support, hitting new 52-week highs, and laggard bank stocks like the Bank of Montreal (BMO) staging a push through trend line resistance.

Always a key foundation of a healthy stock market, financial sector strength will whet even more investor appetite as less investment-savvy Canadians are once again encouraged to commit savings to the stock market in the face of another tax season. The glimmer of banking sector polish can certainly be found in the recent performance of the BMO Equal Weight Banks Index ETF (ZEB). Although a relatively new trading instrument (listed in 2009), this fund with equal weightings for each of the six major Canadian banks cracked new 52-week highs every week of the past month, trading on relatively high volume most recently. The fund price is up 7 per cent in the past month – better than the 5 per cent gain logged by the broader blue chip S&P/TSX 60 index over the period.

Interest rate sensitive stocks must always juggle the double edged sword of elevating interest rates. The financial sector makes hay when the monetary environment allows for a profitable spread between short-term and long-term rates. Long-term rates have been rising since early in the fourth quarter of last year, a move that is inversely reflected in the bearish trend of the iShares DEX Long Term Bond Index ETF (XLB) and other bond funds. Strong Q4 2010 economic performance reported this week adds pressure on the Bank of Canada to lift short term rates, a factor that raises questions about how the consumer and businesses will fair ahead. Judging by investors’ demand for bank stocks, the answer must be: just fine.

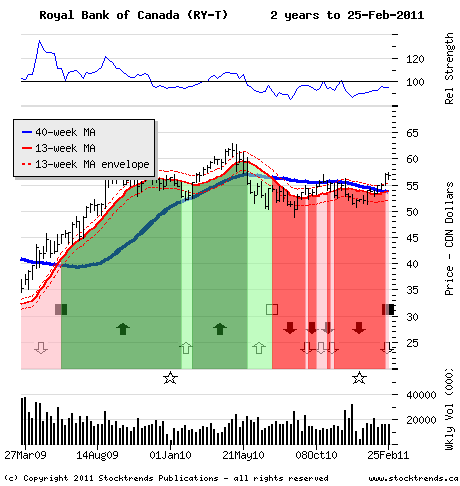

The Trade: This column returns to Royal Bank of Canada eight months after a bearish profile advised market timing investors to take to the sideline when shares traded around $51. After its summer slide, the stock did rally to a high of almost $57 in October, just prior to the end of the company’s fiscal yearend, but shares retreated again to a low of $50.78 by Christmas – a flat six-month performance while sporting the Stock Trends Bearish indicator. However, after the recent rally of bank stocks Royal Bank has closed out its Stock Trends bearish trend and is now a Bullish Crossover. This is the tenth time this stock has had a bullish moving average crossover since 1995 – the period in which the Stock Trends indicators have been published in this newspaper – with the bullish trends that followed averaging about 65 weeks in duration.

The last four Royal Bank bullish trends introduced by the Stock Trends moving average crossover resulted in average 33 per cent share price advance to the trend peak. The bearish call on this stock was largely a trend notice of downside risk. With Royal about to declare first quarter fiscal results, this bullish Stock Trends signal is notice of upside potential ahead.

The Upside: As the share price trades above $57 - clearing the price resistance level that retarded the stock’s rally last autumn - new price objectives blossom for Royal Bank shareholders. Look for the stock to clear the 2010 peak of $62.89 as the banking sector gains traction.

The Downside: Spring may be in the air for bank stocks. Are dividend hikes in the offing? But an economy too heated, interest rates ticking upward, high gas prices taxing the wallets of consumers – these are the risks that might become apparent if the stock drops significantly below $52. Still, there are few investments as golden as a bullish trending bank stock.

Published in Stock Trends