Investors anxious about the concerning downward drift of holdings in the media industry should set their phones for stock alerts, watch the tickers on their television screen, and read the paper more frequently.

The Stock: Quebecor Inc. (QBR.B) Recent price: $34.60

Trend: Intense competition in the media industry has driven fresh moves toward convergence as big players assemble the right mix of content and delivery platforms. The proliferation of smart phone and tablet devices has enabled a business model that emphasises streams of revenue outside the traditional broadcast channels, heightening M&A activity in the industry. BCE Inc.’s (BCE) return to the content arena – a $1.3-billion investment in CTV and its media assets the most high profile evidence of the renewed push toward marrying content with distribution channels.

The stock performance of some of these Canadian media conglomerates is a mixed bag of market cheer and trepidation. Yes, BCE and Telus (T) have maintained a Stock Trends Bullish category since the third quarter of 2009, but the stocks of competing national integrated media properties Rogers Communications (RCI.B) and Shaw Communications (SJR.B) have been in bearish trends after petering out in the tail end of last year. The growth trajectory of Quebec-based Cogeco (CGO) shows as the best performing stock in the group, although Torstar (TS.B), which bounced back to its 52-week high last week, rounds out the glass half-full segment of this industry survey with its bullish stock trend. However, other media content stocks are showing weakness, such as Astral Media (ACM.A), Yellow Media (YLO) and Transcontinental (TCL.A), which dropped on high volume last week. Investors anxious about the concerning downward drift of holdings in this dynamic group should set their phones for stock alerts, watch the tickers on their television screen, and read the paper more frequently.

The Trade: Quebecor Inc. is another dynamic media conglomerate with considerable market share in the Quebec market. Its purchase of Groupe Videotron and its TVA Group (TVA.B) broadcast properties in 2000 gave it the largest cable operator in La belle province, complementing its stable of French language publishers. It also owns Sun Media group, with Canada’s largest chain of urban tabloids. The company’s dominant media position in Quebec is a result of its growth positioning over the past decade, and its stock performed better than most major Canadian media stocks coming out of the 2008 recession. It was tagged as Stock Trends Bullish in mid-2009 at $19.71.

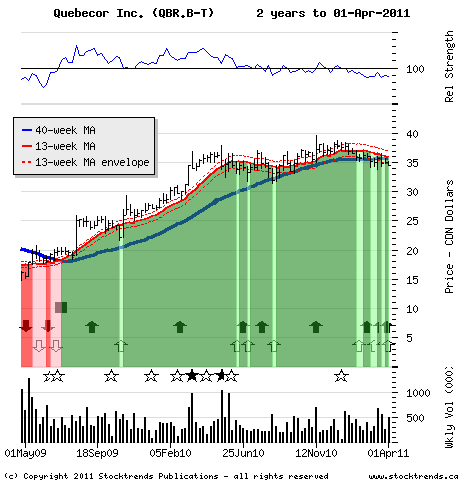

However, shares of Quebecor have been slipping in 2011, falling to the $34 level from their $39.62 high reached in November of last year. Important for shareholders to acknowledge is the impending moving average crossover that will put Quebecor in a Stock Trends Bearish category. Although the broad TSX sentiment remains bullish, (about 76% of stocks are categorized as Stock Trends Bullish), there has been a Bullish trend attrition in recent weeks. A Stock Trends Bearish Crossover – indicating the 13-week moving average trend line has dropped below the 40-week moving average trend line – affirms that the downward sloping trend will act as resistance ahead, making further drops in the share price a likely result. Shareholders should prepare to have their commitment to the stock tested.

The Upside: This section’s title seems a bit of a misnomer when a sell trade is profiled. The upside of every sell is simply a transfer of risk to other assets. Continued market underperformance puts this stock at a risk of dropping another 10 per cent before technical support kicks in. Other trades beckon market timing investors with better technical signals.

The Downside: Evidence of media stock weakness in broadcast and publishing content areas does not correspond to what is generally considered a relatively strong prospect for our domestic economy. Indeed, some analysts are still keen on Quebecor with its special media position in the province and wireless growth potential. If the share price scales back above $36, this bearish call could be reconsidered.

Published in Stock Trends