Investors hungry for returns should start fishing in the oil patch again. Ivanhoe Energy's stock could rally 30% if it clears resistance.

The Stock: Ivanhoe Energy Inc. (IE-T) Recent price: $2.20

The Trend

Canadian equity investors looking at their most recent statements are

surely pleased with the healthy advance of mining stocks in the third

quarter - the sector rose 47 per cent.

Now if only those sluggish energy stocks would, well, energize. Activity

is finally picking up in this important sector as many oil producer and

oil services stocks are rallying with the price of crude oil moving

above $80 (U.S.) last week. Crude prices last flirted with this level in

August before retreating, so technically minded traders will be watching

how the commodity performs early in the final quarter of the year.

Although the economic signals are far from positive, a scaling of the

$85 marker could unleash new faith in petroleum stocks.

Granted, the performance of the S&P/TSX Energy index over the past three

months remains near the bottom among Canadian sectors and the long-term

trend line of the index has been flat for a year, but last week's

5-per-cent pop is its best weekly gain and the only time it has topped

weekly TSX sector performance since April. That's a long time on the

sideline for a sector that is worth 26 per cent of the S&P/TSX composite

index.

The absence of the energy sector in recent market rallies has been

notable. In the past year, only two of the weekly Stock Trends profiles

have been on energy stocks, and one of those profiles - ShawCor, in May

- advised a "sell." However, ShawCor leapt 13 per cent last week to hit

a 52-week high.

In general, oil producer and driller stocks enjoyed a great week.

Canadian Natural Resources added 8 per cent to its share price. Enerplus

Resources Fund, a fund invested in producing properties in North

America, drove through some long-term resistance and hit a new 52-week

high. Suncor Energyalso became the first of Canadian integrated oil

stocks to be categorized as Stock Trends Bullish.

All may be indicators of changing sentiment for the sector, and worth

noting for TSX equity returns ahead. A stronger energy sector means the

economy is on firmer footing. Investors hungry for happy returns from

this dominant group of Canadian stocks should start fishing in the oil

patch again.

The Trade

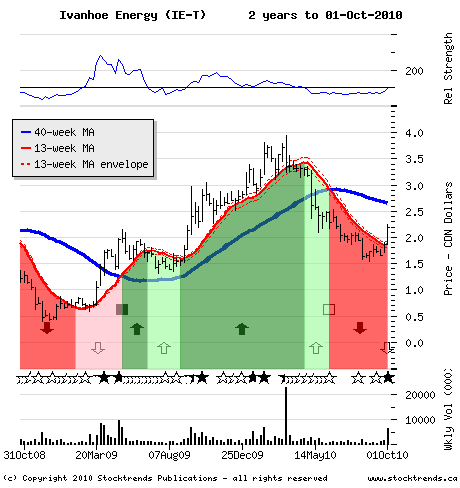

Ivanhoe Energy finished September strongly, rallying on high volume and

closing on Friday at $2.20, a share-price resistance level that offers

investors an important cue for a momentum trade. The stock is now

categorized as Stock Trends Weak Bearish, a signal that the share price

has moved above intermediate-term trend line resistance.

The stock is also listed on the Nasdaq (IVAN) where its transactions

last week totalled more than the previous six weeks combined. Previous

periods in which Ivanhoe's stock has been Weak Bearish but trading

volume has been high have often signalled growing price momentum for

this small-capitalization play. Investors who think the energy

resurgence is a prelude to a strong quarter ahead can join the

optimistic set by buying this enticing stock.

The Upside

The trend analysis presented here has little to do with fundamental

valuations. It is about how the market responds to changing fundamental

evaluations and how a stock's price and volume changes present tradable

patterns. This chart suggests a potential 30-plus-percentage-point gain

if the stock clears current resistance.

The Downside

If last week's crude oil move above $80 proves fleeting, prepare to exit this trade at the 13-week moving average trend line, equivalent to last week's opening price of $1.87.