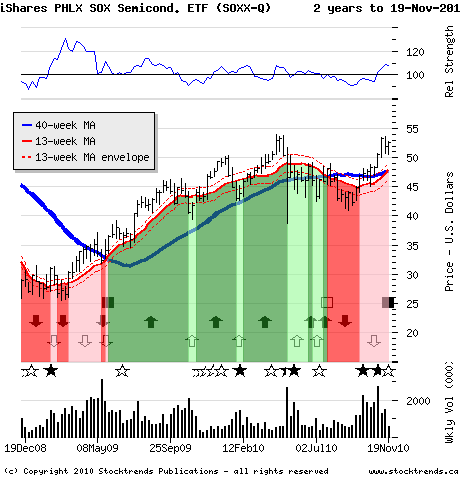

Semiconductor stocks are gaining price momentum. Look for the iShares PHLX SOX to rally above resistance.

|

The Stock: iShares PHLX SOX Semiconductor Sector Index Fund (SOXX-Q) Recent price: $50.58

Trend: Technology stocks have shown improved relative price performance in recent weeks as they regained investor confidence in the autumn market rally. The S&P Technology index is a current Stock Trends Bullish Crossover, an indicator that this broad sector has rallied above its long-term trend line. The index is also approaching the 2010 peak it retreated from in the second quarter.

Leading the way for the sector are networking and software stocks, but semiconductor shares are also attracting bullish players rotating into the space. Broadcom (BRCM-Q) jumped 9 per cent last week, hitting a new 52-week high after announcing third quarter results. Bullish circuit makers Qualcomm (QCOM-Q), Marvell Technologies (MRVL-Q) and Skyworks Solutions (SWKS-Q) have handily outperformed the broad stock market over the past three months. Other chip stocks hitting highs last week were Texas Instruments (TXN-N) and Analog Devices (ADI-N), while semiconductor equipment and materials stocks like Applied Materials (AMAT-Q), United Microelectronics (UMC-N), and Advanced Semiconductor Engineering (ASX-N) have rallied enough to trigger trend alerts in October. The biggest name in the sector, Intel Corp. (INTC-Q), has lagged other semiconductor stocks, but lifted to its 40-week moving average trend line last week.

The Trade: Recently rebranded as the iShares PHLX SOX Semiconductor Sector Index Fund after the well-known capitalization-weighted benchmark for the industry it tracks, this exchange traded fund is probably the best place for investors interested in diversified exposure to the sector. The most actively traded basket of the sector is the HOLDRS Merrill Lynch Semiconductor Trust (SMH-N), but this static portfolio is heavily concentrated. Its top three holdings - Intel, Texas Instruments, and Applied Materials - have a 53 per cent total weighting. Those three stocks account for a more modest 24 per cent of the SOX index, so the iShares semiconductor fund fairly represents broader price movements of the industry - capturing more of the recent moves by Broadcom and Marvel Technologies, for instance.

Periods of relative price performance of chip heavyweights generate superior sector returns for the Semiconductor HOLDRS, but the trust is lagging the SOX in the current sector rally and the big three stocks have immediate price resistance levels to battle through. Technical patterns for Broadcom and Marvel Technologies, as well as other semiconductor stocks, suggest continued rallies in these stocks, helping keep the SOX performance ahead of the HOLDRS trust in the closing months of the year.

Reflecting the market’s interest in the broader semiconductor index, the iShares SOX ETF traded actively last week – more than double its average weekly volume of shares traded. Trading picked up in this sector index fund in mid-September as its price climbed back above the long-term trend line. The rebranding of the fund is likely to maintain active interest and liquidity. Competing unleveraged ETFs in the group include the Powershares Dynamic Semiconductors Portfolio (PSI-N) and the SPDR S&P Semiconductor fund (XSD-N), both considerably less liquid.

The Upside: The SOX index is now open to regain its April high at 404.70, a 9 per cent move above its current level at 372.64. The iShares PHLX SOX ETF’s price would scale above $55 by that advance in the underlying index.

The Downside: Fundholders may have to weather a retreat by the SOX index to support near 337, a 10 per cent drop from the current level, if the broad stock market slips. Swing traders will likely tag $46.90, support at the primary trend line, as an exit trigger for the fund.

|

Published in Stock Trends