Canadian investors should have their finger to the southerly wind, and consider either investing in defensive U.S. sectors, or take a bear market position on the TSX.

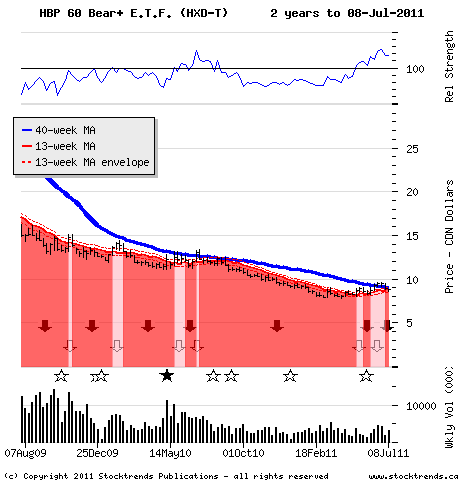

The Stock: Horizons BetaPro S&P/TSX 60 Bear Plus Fund (HXD) Recent price: $9.04

Trend: A tough spring for equities is behind us, but the market’s future beyond the summer months may be even more dismal than it appears in the rear view mirror. Although investors have staged a fitful market rally in recent weeks, there is no glossing over the current trend picture: the number of TSX stocks burdened by downward trending prices has begun eclipsing those still hanging on to long-term bullish price trends. When the market’s price trend distribution shows that most stocks have dropped below support levels and have overhanging, downward sloping trend lines, the foundation for a market recovery is weak.

Since the Stock Trends indicators were first published by The Globe and Mail almost two decades ago there have been seven occasions, prior to the current situation, where the trend distribution of the Toronto Stock Exchange has dipped toward a bearish weighting after a significant bullish trend distribution (periods where bullish trending stocks outnumbered bearish ones by a ratio of at least 2 to 1). Most of these bearish backwash moments are familiar doorways to periods of market losses: Spring 1994, Autumn 1997, Spring 2002, Spring 2004, Spring 2006, and Summer 2007. However, last summer also brought about a flushing of the bulls, only to have the market promptly recover and succeed in generating impressive gains subsequently.

Nevertheless, the current rate of attrition among bullish trending stocks on the TSX is a dark cloud in this year’s summer sky.

Also worth noting is a divergence of the TSX’s trend distribution from that of U.S. equities. On the NYSE, bullish trending stocks – those with Stock Trends bullish indicators – still outnumber bearish ones by a margin of 2.4 to 1. The ratio is only 1.4 to 1 on the NASDAQ, but overall U.S. equities are holding their bullish long-term trends much better than the resource-heavy Canadian stock market. In U.S. dollar terms the Canadian market is down about 7 per cent in the past three months - a limp performance compared to a modestly positive gain for the S&P 500 index. Canadian investors should have their finger to the southerly wind, and consider either investing in defensive U.S. sectors, or take a bear market position on the TSX.

The Trade: With the exception of a brief pause in the summer sun last year, Canadian blue chip stocks have enjoyed a pretty good ride since the S&P/TSX 60 index turned Stock Trends Bullish in mid-2009. But over half of stocks in the group are now struggling with either bearish trends or have retreated below their still upward sloping trend lines. The materials and energy sectors account for about 48 percent of the index, so the retreating commodity trend lines have been a real setback for the index.

Also dragging the index are financials, which account for 30 per cent of the S&P/TSX 60 index. The big banks looked good for further advances along their bullish trends in the spring, but have since turned in an uninspired performance. The end result of withering shares prices in these critical sectors: the blue chip index is about to turn Stock Trends Bearish, so trend following investors can take their cue to exit, or perhaps – more boldly - short the index with the Horizons BetaPro S&P/TSX 60 Bear Plus Fund.

The Upside: The underlying index is technically at risk of retreating to the level it hit a few weeks ago – a 7 per cent advance for this instrument. A bearish trend for the S&P/TSX 60 index could take its valuation back to last summer’s level – a near 10 per cent drop that this inverse fund could amplify into considerable positive returns in that bearish scenario.

The Downside: Generally, a leveraged fund like this should be considered as a short-term trade, and has implicit risk that would make it an unsuitable investment for many. A sudden resurgence of commodity stocks or financials would hit hard and fast. Dips back to the $8.25 area should turn the knuckles pale.

Published in Stock Trends