As oil prices climb the oil sands are looking more attractive. Investors are smitten again with Canada's black bounty.

The Stock: Canadian Oil Sands Ltd. (COS) Recent price: $32.34

Trend: Upward spirals in energy prices bite hard into the world economy, taxing the incomes of consumers and testing the limits of corporate profitability. And like all taxes, high energy prices force a misallocation of resources, and disrupt all sectors of the economy with predictable, as well as unintended consequences. Initial price shocks stir the population’s grievance, and increasingly dominate conversations everywhere. Rising energy prices are a trend that escapes no one.

Investors, of course, must navigate these disruptions. Regardless of whether your holdings are in the energy sector, high crude oil prices – the core fuel of modern industrial economies, as well as developing nations – will have deleterious as well as beneficial effects on equity assets. Determining the consequence of the current rally of oil prices – solidly above $100 per barrel for WTI crude – is now a primetime occupation for institutional money managers and small investors alike.

Since last fall the energy sector’s trend signal have attracted capital to oil & gas producer and service stocks. This column has opportunity to highlight a limited number of stocks, but the energy profiles here have mirrored some of the handsome returns pocketed by market timing investors riding the sector’s wave: Ivanhoe Energy (IE), Total Energy Services (TOT), and BlackPearl Resources (PXX) have risen 69 per cent, 84 per cent and 52 per cent respectively since being featured here in the autumn.

For those investors that believe sub-$100 crude oil is a thing of the past - and that the world economy is in for a long spell of energy insecurity – the oil sands of Western Canada should continue to light a fire in investor portfolios. Reflecting the building price momentum is the Claymore Oil Sands ETF (CLO). Trading in the fund has been spurred by the rise in oil prices, with this basket of bitumen producers now up 27 per cent in the past three months, outpacing the broader energy sector’s 20 per cent gain. Big performers among energy plays in the oil sands include Imperial Oil (IMO), along with Ivanhoe and BlackPearl, with Suncor (SU) also up 14 per cent in the last month. Lent is about to commence, but there should be no abstaining from this sector.

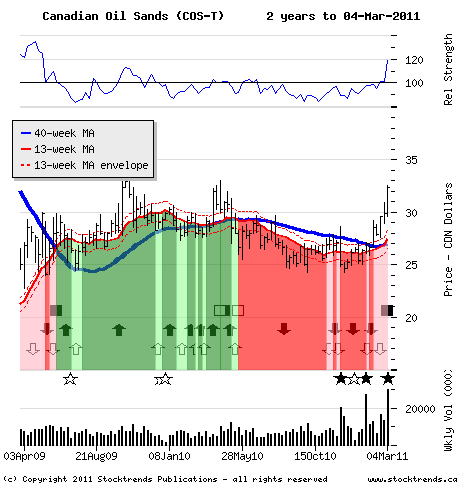

The Trade: A current Stock Trends Bullish Crossover, Canadian Oil Sands is signalling a trend trading opportunity. Rising on high trading volume last week, shares look attractive as they approach resistance levels that beat back the stock in the past two years. Stock Trends alerted to a move above trend when this stock was labelled as Weak Bearish a month ago, but as the price scales the $33 mark additional headroom appears.

The Upside: Although Canadian Oil Sands’ price history as an income trust (it is among the many energy trusts that have converted to corporations) perhaps distorts comparisons of the valuations the market assigned for its units in the past with the potential valuations ahead for the stock, a further15 per cent short term move to the $38 level should be an achievable, conservative objective. When the price of crude headed north of $140 in 2008 Canadian Oil Sands share price (then units) peaked above $50.

The Downside: Dictators retire to quiet retreats, and ascendant democratic people take the reins in oil-rich countries. Americans says enough of with their energy eco-fantasy and sing in harmony: “Drill, drill, drill”. China’s growth sputters. Short of game-changing dreams like those, trend traders entering now can spot 10 per cent on the current price and exit on a drop below $30 if the sector fire extinguishes.

Published in Stock Trends