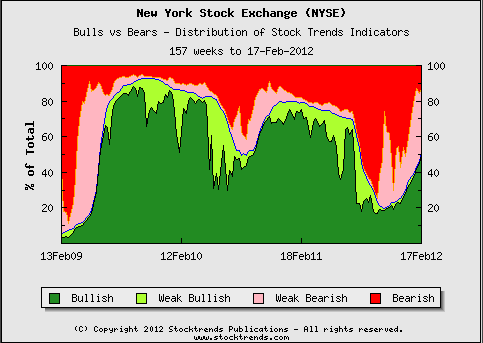

The Stock Trends NYSE Bull/Bear Ratio has turned bullish. Growing investor confidence is apt to push U.S. equities even higher in 2012.

|

Notes of bullishness are ringing louder for U.S. equities. A market rally generally adds to investor confidence, and the already generous 8 percent move in the S&P 500 index since the beginning of the year has market prognosticators looking for more. Adding to this awakening is the uptick in our Stock Trends NYSE Bull/Bear Ratio which is now reading positive for the first time since a bearish grip took hold of the market again in the summer of last year.

Since the beginning of the year the number of strong Bullish (

For more conservative market-timing investors this Bullish turn in the distribution of Stock Trends indicators delivers a fresh opportunity to increase their exposure to U.S. equities. Past bullish readings of the Stock Trends Bull/Bear Ratio are fairly supportive of confidence in this signal.

The last two periods of a positive (above 1.00) Stock Trends Bull/Bear Ratio on the NYSE have correlated with the following returns when measuring the S&P 500 index from the date of the positive signal for the ratio to the date of the return of the Stock Trends Bull/Bear Ratio below 1.00, signalling a Bearish trend distribution.

The current bullish reading of the Stock Trends Bull/Bear Ratio confirms that the market foundation is in place for more gains this year. |

Published in Stock Trends